Establishing a coordination mechanism for urban real estate financing, accurate support for eligible real estate projects through the “whitelist” mechanism is an important measure to promote the steady and healthy development of the real estate market.The reporter learned from the financial regulatory authorities in many places that at present, all places are accelerating the implementation mechanism to meet the financing needs of the real estate “whitelist” project.

The financial regulatory departments of Anhui, Chongqing and other places jointly formulated the implementation rules of the real estate financing coordination mechanism, detailed the processing, review, and push of the “Whitening List” project.Ensure the smooth operation of the financing coordination mechanism.As of March 18, the first batch of 103 “whitewashing” projects confirmed by the banks and coordination mechanisms at all levels and coordination mechanisms. Commercial banks have completed a total of 61 credit grants, a credit amount of 20.66 billion yuan, and a cumulative lending of 11.65 billion yuan.EssenceChongqing pushed 73 “white list” projects, and has added 4.8 billion yuan in credit to 42 projects and 4.1 billion yuan.

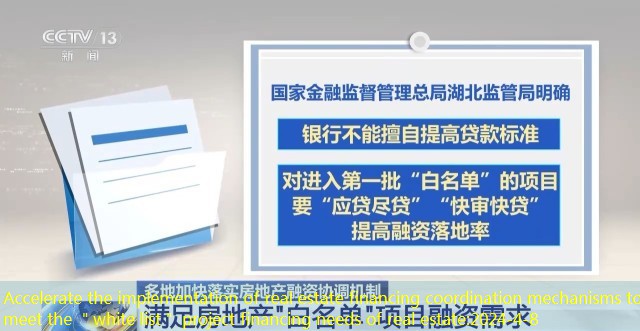

The Hubei Regulatory Bureau of the State Administration of Finance and Administration made it clear that banks cannot improve the loan standards without authorization. For the first batch of “whitewashing lists” projects, they must “loan due to diligence” and “fast -loan” to increase the financing rate of financing.The Jiangsu Supervision Bureau of the State Administration of Finance and Administration of Financial Supervision and Administration promotes the “face -to -face” docking of banks and housing companies, and the possibility of on -site analysis and judgment project financing.At the same time, it is proposed that the qualified “white list” project shall complete the credit approval before the end of March.The Hebei Regulatory Bureau of the State Administration of Finance and Administration requires all banks to complete the first batch of “whitewashing” project credit approval before the end of March, and complete the second batch of “white list” project push work before April 15th to more accurately support real estate projectsReasonable financing.

Many banks also said that they will accelerate the approval of the real estate “whitelist” project.

Hu Hao, deputy governor of CITIC Bank:The next step in our real estate strategy is to “make quality, stabilize, and increase the amount”, and fully implement the coordination mechanism of real estate financing.For the “whitelist” project pushed by the coordination mechanism, we are included in the green approval channel of the whole bank.Resolutely support for good areas, good customers, and good products.

Get funding support “white list” project to accelerate the advancement

The “white list” is simply a coordination mechanism for real estate financing in various places. After sorting out the local real estate projects under construction, the qualified projects are pushed to the bank. This list is the “white list” of real estate financing.Each bank conducts loan review and release to meet the financing needs of the “Whitening List” project.So what about the current effect after being pushed to the bank?The reporter conducted an investigation in Huizhou, Guangdong.

This real estate is one of the first real estate “whitelist” projects in Huizhou City, Guangdong Province.Earlier this month, the bank issued the first loan of 213 million yuan to the project.Today, the main project of the project has been basically completed.

Pan Min, Vice President of Eastern Company, a real estate company:Now the main body of the seven buildings has been capped, and in the stage of batch refinement. We are all implemented in accordance with the plan, delivered by the contract according to the contract, and the first batch is delivered in August 2025.

In February of this year, the special class of the Huizhou real estate financing coordination mechanism launched the first batch of 28 “white list” projects, pushing to various financial institutions.This real estate company has two projects received bank fund support.

Pan Min, Vice President of Eastern Company, a real estate company:Without this loan, our funding pressure is still very large, including our downstream material payment.After relieving the pressure of funds, the construction progress is smoother, and it can also ensure that it is delivered in time in accordance with the contract.

In order to prevent loans from being misappropriated, Huizhou also established a mechanism to conduct closed -loop management of funds and strengthen supervision.

Huang Hairan, president of Huizhou Branch of Zhejiang Business Bank:Our bank signed a fund co -management agreement with the housing enterprises and housing and construction departments to open a dedicated fund account for the project. The real estate enterprise needs to submit an application based on the construction progress. After the housing and construction department and our bank are reviewed, the funds can be allocated to ensure that the special funds are dedicated.

Wang Zhiping, deputy director of Huizhou Housing and Urban -Rural Development Bureau:The housing construction department can verify whether so many projects have occurred. Only when it happened can the housing construction department agree to allocate loans.

According to statistics from the Guangdong Regulatory Bureau of the State Administration of Finance and Administration, by the 21st of this month, 21 prefectures and cities in Guangdong have established urban real estate financing coordination mechanisms and completed the first batch of projects of the “white list”.Each bank has granted more than 60 credit approval projects, with a credit amount of 16.2 billion yuan, of which private and mixed -owned housing companies accounted for more than 80 %.

The financing pressure of real estate companies will further alleviate

The real estate industry chain is long and involved in a wide range.Just last week, the state clearly needed to further optimize real estate policies, continue to grasp the preservation of intersections, protect people’s livelihood, and maintain stability, and further promote the implementation of urban real estate financing coordination mechanisms.

The reporter learned that since last year, a series of measures such as optimizing real estate regulation and controlling real estate in various places have achieved a certain amount of measures, such as the implementation of the preservation of intersections and reducing mortgage interest rates, have achieved certain results.The real estate financing coordination mechanism launched this year has eased the mobility pressure of many real estate companies, promoted the construction progress of projects with normal development and construction and guaranteed repayment sources, and promoted the insurance delivery building.

Huang Guoqiang, the person in charge of a real estate company in Guangdong:Our financing demand, the two projects are about 30 million. We get this financing. This year, this project can be opened and can be successfully invested in the market.

Zhou Qiang, vice president of an Eastern Company of a real estate enterprise:It provides a strong guarantee for the development and construction of the project, and has established a strong confidence for our development enterprises. It is of great significance to the asset activity of our next project and the improvement of sustainable operating capabilities.

The reporter noticed that from January to February of this year, real estate development investment in the country was 1184.2 billion yuan. Although it was still declining year -on -year, the data of 0.6 percentage points in a month -on -month increase from the data at the end of last year.

Industry insiders believe that the real estate financing coordination mechanism is expected to continue to make efforts to further alleviate the mobility pressure of real estate companies.The report of the National Financial and Development Laboratory also believes that with the comprehensive implementation of the real estate financing coordination mechanism, the financing situation of real estate enterprises will be greatly improved, and the liquidity risks of the real estate industry will be significantly relieved.This year, the real estate market will continue the current easing policy and gradually build a housing system that is compatible with the new model of real estate development.